A tax audit is a comprehensive examination or review of a taxpayer’s financial records and transactions to ensure that they have accurately reported their income, deductions, credits, and other relevant financial information on their tax returns. Tax authorities, such as the Internal Revenue Service (IRS) in the United States, conduct tax audits to verify the accuracy and compliance of taxpayers with the tax laws and regulations.

During a tax audit, tax authorities scrutinize various financial documents, including income statements, expense receipts, bank statements, and supporting documentation for deductions and credits. The purpose of the audit is to identify any discrepancies, errors, or intentional misrepresentations in the taxpayer’s reported financial information. Tax audits can be triggered randomly, based on certain risk factors, or as a result of specific red flags found in a taxpayer’s return.

There are different types of tax audits, including:

- Correspondence Audit: This is a relatively simple and less invasive audit where the tax agency requests specific documentation or clarification on certain items through mail or email.

- Office Audit: In an office audit, taxpayers are required to meet with tax authorities at a local tax office. They need to bring relevant documents to support their tax return claims.

- Field Audit: A field audit involves tax authorities visiting the taxpayer’s home, business, or place of work to conduct a more comprehensive examination of financial records.

- Random Audit: Some audits are conducted randomly to ensure overall compliance with tax laws and regulations.

- Examination Audit: This is a thorough review of a taxpayer’s financial records, usually focusing on specific items that appear suspicious or inconsistent.

The outcome of a tax audit can vary. If the taxpayer’s records and claims are found to be accurate, the audit will conclude without any further actions. However, if discrepancies are discovered, the taxpayer may be required to pay additional taxes, penalties, and interest on underreported amounts. In cases of intentional fraud or deliberate misrepresentation, more serious consequences such as criminal charges could be pursued.

To navigate a tax audit successfully, it’s crucial for taxpayers to maintain accurate and organized financial records, respond promptly and transparently to audit requests, and, if necessary, seek professional assistance from tax advisors or accountants.

purpose of a tax audit

The purpose of a tax audit is to verify the accuracy, completeness, and compliance of a taxpayer’s financial information and tax reporting with the applicable tax laws and regulations. Tax authorities, such as the Internal Revenue Service (IRS) in the United States, conduct tax audits to achieve several key objectives:

- Ensure Compliance: The primary purpose of a tax audit is to ensure that taxpayers are complying with the tax laws and regulations of their jurisdiction. Audits help identify instances of intentional or unintentional non-compliance, such as underreported income or overstated deductions.

- Verify Accuracy: Tax authorities aim to verify the accuracy of the financial information reported by taxpayers on their tax returns. Audits help ensure that income, expenses, credits, and deductions have been reported correctly.

- Maintain Equity: Tax audits contribute to maintaining a fair and equitable tax system by preventing tax evasion and ensuring that all taxpayers contribute their fair share based on their actual financial situation.

- Deter Tax Evasion: The possibility of audits serves as a deterrent against tax evasion and fraudulent activities. Knowing that there is a chance of being audited encourages taxpayers to accurately report their financial information.

- Collect Revenue: Audits can result in the collection of additional tax revenue when discrepancies are found and corrected. Tax authorities recover unpaid taxes, penalties, and interest from taxpayers who have underreported their income or claimed improper deductions.

- Promote Voluntary Compliance: By conducting audits, tax authorities promote voluntary compliance with tax laws. The fear of audits encourages taxpayers to maintain proper records and report their financial information accurately.

- Enhance Tax System Integrity: Audits help maintain the integrity of the tax system by addressing issues of non-compliance and ensuring that taxpayers have confidence in the fairness of the system.

- Educational Opportunity: Tax audits provide an educational opportunity for taxpayers to better understand tax laws and regulations. Through the audit process, taxpayers can learn about their reporting obligations and improve their recordkeeping practices.

- Identify Trends and Risks: Tax authorities can identify trends, patterns, and high-risk areas through audit activities. This information helps them target enforcement efforts more effectively and make improvements to tax administration.

- Support Law Enforcement: In cases of intentional tax fraud or evasion, audits provide evidence for potential legal actions and prosecutions against individuals or businesses engaged in illegal activities.

Overall, the purpose of a tax audit is to maintain the integrity of the tax system, promote compliance, and ensure that taxpayers accurately report their financial information while contributing their fair share of taxes to fund government operations and services.

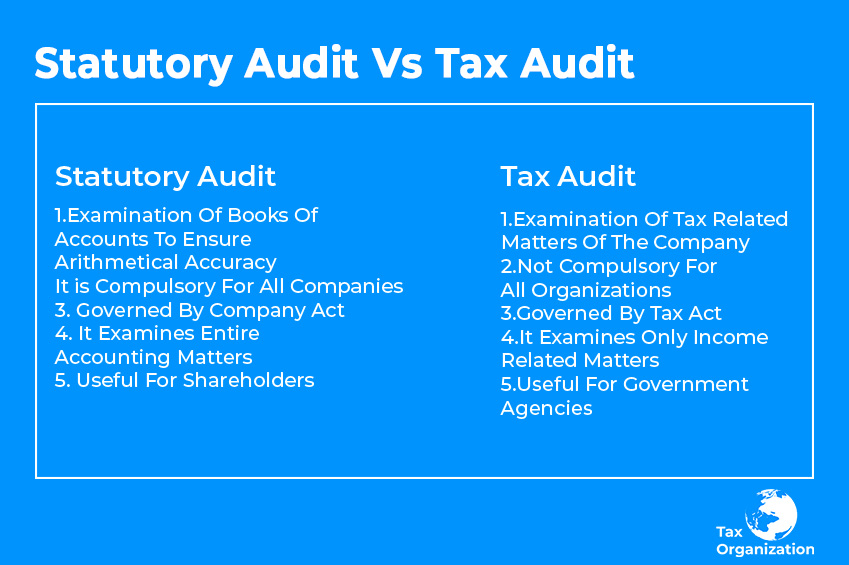

Statutory Audit vs. Tax Audit

Statutory Audit and Tax Audit are two distinct types of audits conducted for different purposes, although they both involve examining financial records and statements. Here’s a comparison of the two:

Statutory Audit:

- Purpose: A statutory audit, also known as an external audit, is conducted to provide an independent and objective assessment of a company’s financial statements and accounts. The primary goal is to ensure that the financial statements present a true and fair view of the company’s financial position and performance.

- Mandatory Requirement: Statutory audits are typically mandatory for companies and organizations, as required by law or regulations. The objective is to enhance transparency, accountability, and investor confidence in the financial reporting of businesses.

- Conducted By: Statutory audits are performed by external auditors who are independent of the company. These auditors are usually certified public accountants (CPAs) or chartered accountants (CAs) and are appointed by the shareholders of the company.

- Scope: The scope of a statutory audit includes examining the financial statements, accounting records, internal controls, and financial processes of the company. The auditor’s objective is to express an opinion on whether the financial statements are free from material misstatements and fairly represent the company’s financial position.

- Reporting: At the conclusion of the audit, the external auditor issues an audit report expressing their opinion on the accuracy and reliability of the financial statements. The report includes an assessment of the company’s internal controls and any significant findings.

Tax Audit:

- Purpose: A tax audit is conducted by tax authorities to verify the accuracy and compliance of a taxpayer’s financial information with the applicable tax laws and regulations. The primary goal is to ensure that taxpayers have accurately reported their income, deductions, and credits.

- Requirement: Tax audits can be triggered randomly or based on certain risk factors identified by tax authorities. They are typically conducted to prevent tax evasion and ensure that taxpayers are paying the correct amount of taxes.

- Conducted By: Tax audits are conducted by officials from the tax authority, such as the Internal Revenue Service (IRS) in the United States or the tax department in other countries. These officials are responsible for reviewing the taxpayer’s financial records and returns.

- Scope: The scope of a tax audit includes examining the taxpayer’s financial records, income sources, expenses, deductions, and other relevant information. The focus is on identifying discrepancies, errors, or fraudulent activities related to tax reporting.

- Reporting: After completing the audit, the tax authority issues an audit report that outlines their findings and any adjustments made to the taxpayer’s reported information. If discrepancies are found, the taxpayer may be required to pay additional taxes, penalties, and interest.

In summary, while both statutory audits and tax audits involve reviewing financial records, they serve different purposes and are conducted by different parties. Statutory audits are aimed at assessing the accuracy of a company’s financial statements for transparency and accountability, while tax audits focus on verifying the accuracy of a taxpayer’s tax reporting to ensure compliance with tax laws and regulations.

How to do a Tax Audit?

Performing a tax audit typically refers to the process undertaken by tax authorities to examine a taxpayer’s financial records and tax returns for accuracy and compliance. If you are a taxpayer seeking guidance on how to prepare for a tax audit or respond to an audit notice, the following steps can be helpful:

- Review the Audit Notice: Carefully read the audit notice you received from the tax authority. It will specify the purpose of the audit, the years under review, and the items or issues they want to examine.

- Gather Documentation: Collect all relevant documents that support the items being audited. This might include income statements, expense receipts, bank statements, and other financial records. Organize them in a systematic and easily accessible manner.

- Understand Tax Laws: Familiarize yourself with the relevant tax laws and regulations that apply to your situation. Understanding the rules will help you provide accurate explanations and documentation during the audit.

- Consult a Tax Professional: If you’re uncertain about how to handle the audit, consider seeking assistance from a qualified tax professional, such as a certified public accountant (CPA) or tax attorney. They can provide guidance, review your records, and represent you during the audit process.

- Review Your Tax Returns: Thoroughly review the tax returns being audited. Understand how you arrived at the reported figures and be prepared to explain any discrepancies.

- Respond Promptly: Respond to the audit notice within the specified timeframe. If you need more time, communicate this to the tax authorities and request an extension. Failing to respond on time could result in further complications.

- Be Honest and Transparent: During interactions with tax authorities, provide accurate and complete information. Be open and transparent about your financial situation, and avoid making statements that could be misconstrued as false or misleading.

- Provide Documentation: Submit copies of the requested documentation to the tax authorities as directed in the audit notice. Keep the originals for your records.

- Communicate in Writing: Whenever possible, communicate with tax authorities in writing or through your appointed representative. Written communication ensures clarity and creates a record of interactions.

- Prepare for Interviews: If the audit involves an in-person or phone interview, prepare in advance. Review your records and understand the details of your tax return.

- Stay Organized: Keep a record of all communications, documentation, and correspondences related to the audit. This will help you keep track of the process and provide evidence if necessary.

- Cooperate and Respond Promptly: Be cooperative and responsive throughout the audit process. If the tax authorities request additional information or clarification, provide it in a timely manner.

- Be Professional: Maintain a professional and respectful demeanor when interacting with tax authorities. Avoid becoming confrontational or defensive, as this could hinder the audit process.

- Appeal if Necessary: If you disagree with the audit findings, you have the right to appeal. Follow the procedures outlined in the audit notice or seek guidance from a tax professional.

- Learn from the Experience: Use the audit as an opportunity to learn more about tax regulations and improve your recordkeeping and reporting practices for the future.

Remember that a tax audit can be a complex process, and it’s crucial to handle it with care and accuracy. Seeking professional guidance and cooperation with tax authorities will contribute to a smoother audit experience.

Essential Documents Required for Tax audit

The essential documents required for a tax audit can vary based on the specific tax jurisdiction, the nature of your financial transactions, and the type of audit being conducted. However, here’s a list of common documents that are often required during a tax audit process:

- Financial Statements:

- Balance Sheet

- Profit and Loss Statement (Income Statement)

- Cash Flow Statement (if applicable)

- Bank Statements:

- Statements for all bank accounts, including personal and business accounts

- Income Documents:

- W-2 forms (for employed individuals)

- 1099-MISC forms (for self-employed individuals)

- Rental income records

- Interest and dividend statements

- Capital gains and losses statements

- Expense Receipts and Documentation:

- Receipts for business expenses

- Receipts for deductible expenses (medical, education, etc.)

- Travel and entertainment expenses documentation

- Receipts for charitable donations

- Business Records (If Applicable):

- Business purchase and sales records

- Inventory records

- Records of business-related loans and repayments

- Asset and Liability Records:

- Records of property purchases and sales

- Mortgage documents and loan agreements

- Records of major purchases and sales (vehicles, real estate, etc.)

- Documentation of Deductions and Credits:

- Documentation for claimed deductions (home office, education, etc.)

- Supporting documents for tax credits claimed

- Contracts and Agreements:

- Lease agreements

- Loan agreements

- Rental agreements

- Employment Records:

- Payroll records

- Employee contracts and agreements

- Withholding tax records

- Foreign Asset and Income Documentation (If Applicable):

- Foreign bank account statements (FBAR)

- Documentation of foreign income

- Legal and Court Documents:

- Legal agreements

- Court orders

- Settlement agreements

- Previous Tax Returns:

- Copies of previous tax returns for the audit period

- Correspondence with Tax Authorities:

- Any previous correspondence with tax authorities

- Any Notices or Correspondence Received:

- Audit notice or any other communication received from tax authorities

- Additional Documents as Required:

- Depending on the specifics of your audit, you may need to provide additional documents related to your financial activities.

It’s important to keep these documents organized and readily accessible in case of a tax audit. Proper recordkeeping and documentation play a crucial role in successfully navigating the audit process and demonstrating compliance with tax laws. If you are unsure about which documents are relevant to your situation, consult with a tax professional for guidance.

What Can Trigger a Tax Audit?

Several factors can trigger a tax audit by tax authorities. While some audits are conducted randomly as part of compliance checks, certain red flags and risk factors can increase the likelihood of an individual or business being selected for an audit. Keep in mind that these factors might vary depending on the tax jurisdiction and the specific tax agency. Here are some common triggers for tax audits:

- High Income: Taxpayers with unusually high incomes compared to their reported expenses and deductions might attract attention. Large income amounts can lead to scrutiny to ensure accurate reporting.

- Unreported Income: Failure to report all sources of income, such as freelance earnings, rental income, or cash transactions, can raise suspicions of tax evasion and trigger an audit.

- Inconsistent or Abnormal Deductions: Claiming deductions that are significantly higher than the average for your income level or industry can be a red flag. Deductions must be legitimate and supported by proper documentation.

- Home Office Deductions: Taking deductions for a home office space can be a trigger due to its potential for abuse. The space claimed as a home office must be used exclusively and regularly for business purposes.

- Business Losses: Consistently reporting losses in a business for several years might prompt an audit to determine whether the business is a genuine profit-making endeavor or a hobby.

- High Charitable Contributions: Claiming substantial charitable donations without proper documentation or if the claimed amounts seem excessive in relation to your income can be a cause for investigation.

- Cash Transactions: Frequent large cash transactions or a significant amount of unreported cash income can raise concerns about potential unreported income.

- International Transactions: Transactions involving foreign accounts, investments, or income can attract additional scrutiny due to potential for offshore tax evasion.

- Frequent Amendments: Frequent changes or amendments to your tax returns can make your returns appear inconsistent and trigger an audit.

- Self-Employment: Self-employed individuals are more likely to be audited due to the complexity of their income and expenses.

- Alimony Deductions: Alimony payments and deductions can be closely examined to ensure they comply with tax rules.

- Unusual Tax Credits: Claiming unusual or uncommon tax credits that are not typically associated with your circumstances could raise suspicions.

- Errors on Previous Returns: If you’ve made mistakes on previous tax returns, tax authorities might take a closer look at your subsequent returns.

- Industry-Specific Issues: Certain industries, such as cash-intensive businesses like restaurants, may be subject to more audits due to the potential for unreported income.

It’s important to note that while these factors can increase the likelihood of an audit, they do not guarantee one will occur. Maintaining accurate and well-documented records, ensuring consistent and truthful reporting, and seeking professional tax advice can help reduce the risk of triggering an audit.

How to minimize your risk of a tax audit?

Minimizing the risk of a tax audit involves practicing good recordkeeping, ensuring accurate and consistent reporting, and following tax laws and regulations. While it’s impossible to completely eliminate the chance of an audit, you can take several steps to reduce the likelihood. Here are some strategies:

- Accurate Reporting: Ensure that all information on your tax return is accurate and consistent. Double-check your math and verify that your personal information matches official records.

- Maintain Good Records: Keep thorough and organized records of all income, expenses, deductions, and credits. Proper documentation can help support your claims in case of an audit.

- Report All Income: Declare all sources of income, including freelance work, rental income, and side gigs. Failure to report income, even unintentionally, can lead to an audit.

- Claim Legitimate Deductions: Only claim deductions and credits that you are eligible for and have proper documentation to support. Avoid inflating expenses or claiming deductions you can’t substantiate.

- Home Office Deductions: If you’re claiming a home office deduction, ensure that the space is used exclusively and regularly for business purposes. Keep records of expenses related to your home office.

- Consult a Professional: Seek advice from a qualified tax professional, such as a certified public accountant (CPA) or tax advisor, when preparing your taxes. Professionals can provide guidance and help you navigate complex tax laws.

- E-File: Filing your tax return electronically reduces the chances of errors and can be more accurate than paper filing.

- Avoid Round Numbers: When reporting income and expenses, avoid using round numbers. Precise figures can lend more credibility to your return.

- Consistency Over Time: Aim for consistency in your reported income, deductions, and other financial information over multiple years. Frequent changes and inconsistencies may raise suspicions.

- Report International Income: If you have foreign income or assets, report them appropriately, including any required Foreign Bank Account Reports (FBARs) or other disclosures.

- Properly Document Charitable Contributions: If claiming charitable donations, retain receipts or acknowledgments from the charitable organizations to substantiate your claims.

- Educate Yourself: Familiarize yourself with tax laws and regulations relevant to your situation. This knowledge can help you make informed decisions and avoid inadvertent mistakes.

- Avoid High-Risk Actions: Be cautious of engaging in activities that are commonly associated with tax evasion or fraud, such as excessive use of cash transactions.

- Limit Business Losses: If you have a business that consistently reports losses, ensure you have a legitimate business plan and demonstrate efforts to generate profits.

- Respond to Notices Promptly: If you receive a notice or correspondence from tax authorities, address it promptly and provide requested information as accurately as possible.

- Stay Updated: Tax laws can change, so stay informed about updates that might affect your tax situation.

Remember that these steps are intended to reduce the risk of an audit, but they cannot guarantee that you won’t be audited. If you are selected for an audit, maintaining good records and cooperating fully with tax authorities will help the process go more smoothly.

What to do if you receive a tax audit?

If you receive a tax audit notice, it’s important to remain calm and take appropriate steps to address the situation. Here’s what you should do if you receive a tax audit:

- Read the Notice Carefully: Carefully read the audit notice you received. It will provide important information about the scope of the audit, the tax years under review, and any specific issues or documentation that tax authorities are questioning.

- Understand Your Rights: Familiarize yourself with your rights as a taxpayer during the audit process. You have the right to representation, the right to appeal, and the right to confidentiality.

- Contact a Professional: Consider seeking assistance from a qualified tax professional, such as a certified public accountant (CPA) or tax attorney. They can help you understand the audit process, gather the necessary documentation, and represent you during communications with tax authorities.

- Gather Documentation: Collect all relevant documents that support the items being audited. This might include income statements, expense receipts, bank statements, and other financial records. Organize them in a clear and easily accessible manner.

- Review Your Tax Return: Review your original tax return for the years being audited. Ensure that you understand how you arrived at the reported figures and be prepared to explain any discrepancies.

- Respond Promptly: Respond to the audit notice within the specified timeframe. If you need additional time, communicate this to the tax authorities and request an extension. Failing to respond in a timely manner can lead to further complications.

- Be Honest and Transparent: When communicating with tax authorities, be honest and transparent. Provide accurate and complete information, and avoid making statements that could be construed as misleading or false.

- Provide Documentation: Send copies of the requested documentation to the tax authorities as instructed in the audit notice. Keep the originals for your records.

- Communicate in Writing: Whenever possible, communicate with tax authorities in writing or through your appointed representative. Written communication helps ensure clarity and documentation of all interactions.

- Stay Organized: Maintain a record of all communications, documentation, and correspondences related to the audit. This will help you keep track of the process and provide evidence if needed.

- Be Prepared for Interviews: If the audit involves an in-person or phone interview, prepare in advance. Review your records and familiarize yourself with the details of your tax return.

- Remain Professional: Maintain a professional and respectful demeanor when interacting with tax authorities. Avoid confrontational or defensive attitudes, as this can hinder the audit process.

- Appeal if Necessary: If you disagree with the audit findings, you have the right to appeal. Follow the appropriate procedures outlined in the audit notice or seek guidance from a tax professional.

- Learn from the Experience: Use the audit as an opportunity to learn more about tax regulations and how to improve your recordkeeping and reporting practices in the future.

Remember that the goal of the audit process is to ensure accurate reporting and compliance with tax laws. Having a professional by your side can greatly help navigate the process, address any concerns, and increase the likelihood of a favorable outcome.