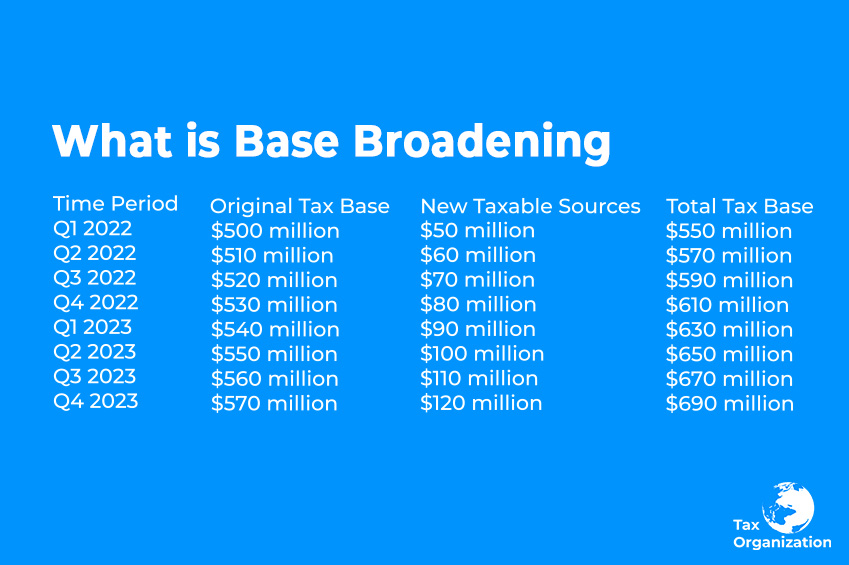

Base broadening refers to the expansion or increase in the tax base, which is the range of economic activities, assets, or transactions that are subject to taxation. In the context of taxation, a “broad” tax base includes a wide variety of sources of income, economic activities, or assets that are subject to taxation. Broadening the tax base involves including more types of income, transactions, or economic activities in the tax system, which can help generate additional revenue for the government.

Base broadening can be achieved through various measures, such as:

- Reducing Tax Exemptions: Eliminating or reducing exemptions, deductions, or credits that limit the taxable portion of income or activities. This ensures that a greater portion of economic activity is subject to taxation.

- Including New Transactions: Introducing taxes on previously untaxed economic activities or transactions. For instance, expanding sales tax to cover previously exempted goods or services.

- Closing Loopholes: Closing legal loopholes or gaps that allow individuals or businesses to avoid paying taxes on certain income or transactions.

- Curtailing Tax Avoidance: Implementing measures that prevent individuals and businesses from using complex strategies to evade or minimize their tax liabilities.

- Revising Taxation Criteria: Updating the criteria used to determine which entities or activities are subject to taxation, ensuring that the tax system accurately reflects the current economic landscape.

The objective of base broadening is to create a fair and equitable tax system while also raising revenue to fund government expenditures. By broadening the tax base, governments can potentially lower tax rates while maintaining or increasing overall revenue, which can have positive effects on economic efficiency and simplicity in the tax system. However, base broadening can also be politically challenging, as it may involve eliminating or reducing existing tax preferences that benefit certain individuals, businesses, or industries.

Defining the ideal tax base

Defining the ideal tax base involves determining the optimal range of economic activities, assets, and transactions that should be subject to taxation in order to achieve the goals of the tax system. The ideal tax base should be broad enough to generate sufficient revenue for government expenditures while being fair, efficient, and easy to administer.

Key considerations when defining the ideal tax base include:

- Equity and Fairness: The tax base should distribute the tax burden fairly across individuals and entities based on their ability to pay. This may involve taxing income and wealth more heavily for those with higher resources.

- Efficiency: The tax base should minimize distortions to economic behavior. Taxes that discourage productive activities or encourage tax evasion are considered inefficient. An ideal tax base should avoid creating disincentives for work, investment, and consumption.

- Simplicity: A simple tax base is easier to understand, comply with, and administer. Simplicity reduces administrative costs and the potential for confusion or unintentional noncompliance.

- Stability: The tax base should be stable and reliable over time, ensuring a consistent source of revenue for government operations and services.

- Adaptability: The tax base should be able to adapt to changes in the economy and technological advancements. New forms of income and economic activities should be appropriately incorporated into the tax system.

- Transparency: The tax base and its associated rules should be transparent, making it clear how taxes are calculated and encouraging trust in the tax system.

- Avoidance and Evasion Mitigation: The tax base should be designed to minimize opportunities for tax avoidance and evasion, ensuring that individuals and businesses pay their fair share of taxes.

- Balancing Objectives: Defining the ideal tax base requires balancing conflicting objectives. For instance, while a broader tax base might increase revenue, it could also lead to higher compliance costs for businesses and individuals.

The determination of the ideal tax base is influenced by a country’s economic structure, social values, and political considerations. Different types of taxes (e.g., income tax, consumption tax, property tax) may have different ideal tax bases depending on the specific objectives they aim to achieve. Policymakers often engage in detailed analysis and consider public input when crafting tax policies to create a tax base that aligns with societal goals and economic realities.

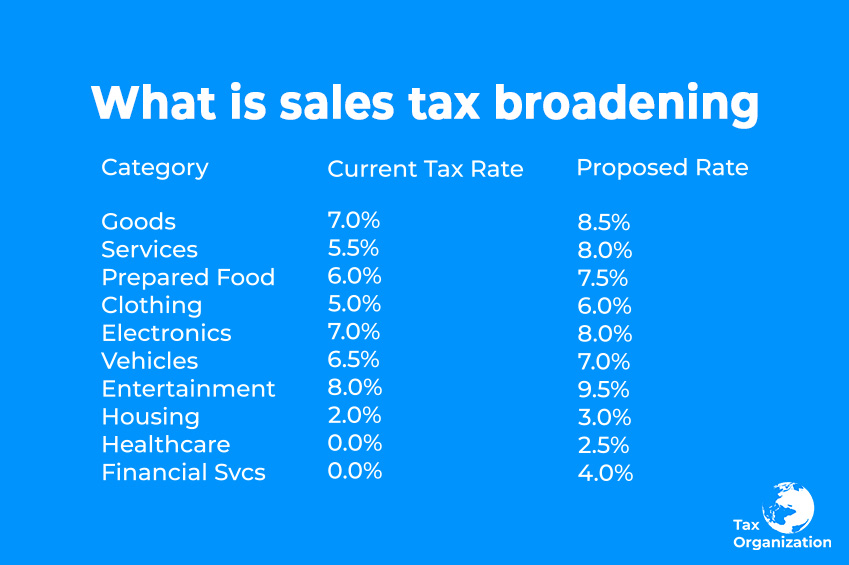

What is sales tax broadening

Sales tax broadening refers to the expansion of the range of goods and services that are subject to a sales tax. A sales tax is a consumption-based tax imposed on the sale of goods and services to end consumers. When a government broadens the sales tax base, it means that they are extending the scope of the tax to cover a wider variety of products and services that were previously exempt or not subject to the tax.

In the context of sales tax:

- Narrow Base: A sales tax with a narrow base applies only to a limited set of goods and services. This could result in certain items being exempt from taxation, which might create disparities in the tax treatment of different products.

- Broadening the Base: Sales tax broadening involves reducing exemptions and expanding the types of goods and services that are subject to the tax. This can help increase government revenue and promote fairness by treating similar products equally in terms of taxation.

- Newly Taxed Items: Items that were previously not subject to sales tax might be included in the tax base. For example, if a country initially taxed only basic necessities like food and medicine at a reduced rate, but later decides to tax these items at the standard rate, it is broadening the tax base.

- Revenue Generation: Sales tax broadening can lead to increased revenue for the government without necessarily raising the tax rate. By covering a broader range of goods and services, the government can collect more tax from a larger portion of economic activity.

- Challenges: Implementing sales tax broadening can be politically and logistically challenging, as it might impact certain industries or consumer groups more than others. There may be debates about which items should be included or exempted from the expanded tax base.

- Fairness and Equity: Broadening the sales tax base can help achieve fairness by ensuring that all consumers contribute to government revenue when they make purchases, regardless of the specific items they buy.

- Economic Impact: The impact of sales tax broadening on consumer behavior and overall economic activity should be considered. It may affect consumer spending patterns and business operations.

Sales tax broadening is a strategy that governments often consider to enhance revenue collection, simplify the tax system, and reduce potential distortions in consumer behavior caused by differential tax treatment of various goods and services. However, careful planning, public engagement, and assessment of potential consequences are essential when implementing such changes to the sales tax system.

Income As a Tax Base

Income is a commonly used tax base in many countries to levy income tax on individuals and businesses. Income tax is a direct tax imposed on the earnings of individuals, corporations, and other entities. The income tax base encompasses various forms of income, including wages, salaries, profits, dividends, interest, rents, and other sources of monetary gain. Defining income as a tax base involves determining which types of income are subject to taxation and at what rates.

Here are key aspects of using income as a tax base:

- Types of Income: Income can be broadly categorized into earned income (such as wages and salaries) and unearned income (such as dividends and interest). Governments decide which specific types of income are taxable and whether certain exemptions or deductions apply.

- Tax Rates: Different forms of income may be taxed at varying rates. Progressive tax systems often impose higher tax rates on higher levels of income, aiming to distribute the tax burden more equitably.

- Taxable Events: Governments define the events that trigger tax liability, such as receiving a paycheck, selling an asset, or earning interest. These events determine when individuals or entities need to report and pay taxes on their income.

- Deductions and Exemptions: Many tax systems allow for deductions (expenses subtracted from gross income) and exemptions (certain amounts of income excluded from taxation) to reflect an individual’s financial circumstances. Common deductions include those related to education, healthcare, and retirement savings.

- Tax Credits: Tax credits directly reduce the amount of tax owed. They can be based on various factors, such as income level, number of dependents, or specific expenses incurred.

- Progressivity: Progressive tax systems tax higher levels of income at higher rates, while regressive systems apply a higher tax burden to lower-income individuals. The choice between these approaches reflects societal goals and values.

- Equity and Efficiency: Designing an income tax base requires balancing equity (fair distribution of the tax burden) and efficiency (minimizing disincentives to work and invest).

- Tax Compliance: Proper administration of income taxes involves accurate reporting and monitoring of income sources. Governments use measures to ensure compliance, including audits and penalties for underreporting income.

- Avoidance and Evasion: Some individuals or entities may attempt to reduce their taxable income through legal means (tax avoidance) or illegal means (tax evasion). Tax laws and enforcement mechanisms aim to prevent such actions.

- International Income: Determining the tax treatment of income earned abroad by residents or corporations involves complex rules to avoid double taxation or tax evasion.

Using income as a tax base provides governments with a reliable source of revenue that can be used to fund public services, infrastructure, and social programs. However, crafting an effective income tax system requires careful consideration of economic impacts, social objectives, and the overall tax structure within a given country.